- Cash Bids

- Market Overview

- Futures

- Options

- Charts

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- AgPlus

- Futures 101

- Commodity Symbols

- Ag Calendar

- Newswire

- InsideFutures

- Brugler Commentary

- Market Commentary by Total Farm Marketing

- CME Hedging Resource Center

- Farmer's Almanac

- USDA News & Reports

How Is ResMed's Stock Performance Compared to Other Healthcare Stocks?

/Resmed%20Inc_%20HQ%20photo-by%20JHVEPhoto%20via%20iStock.jpg)

San Diego, California-based ResMed Inc. (RMD) develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the US and internationally. With a market cap of $39.6 billion, ResMed operates through Sleep and Breathing Health and Residential Care Software segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." RMD fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the medical instruments & supplies industry.

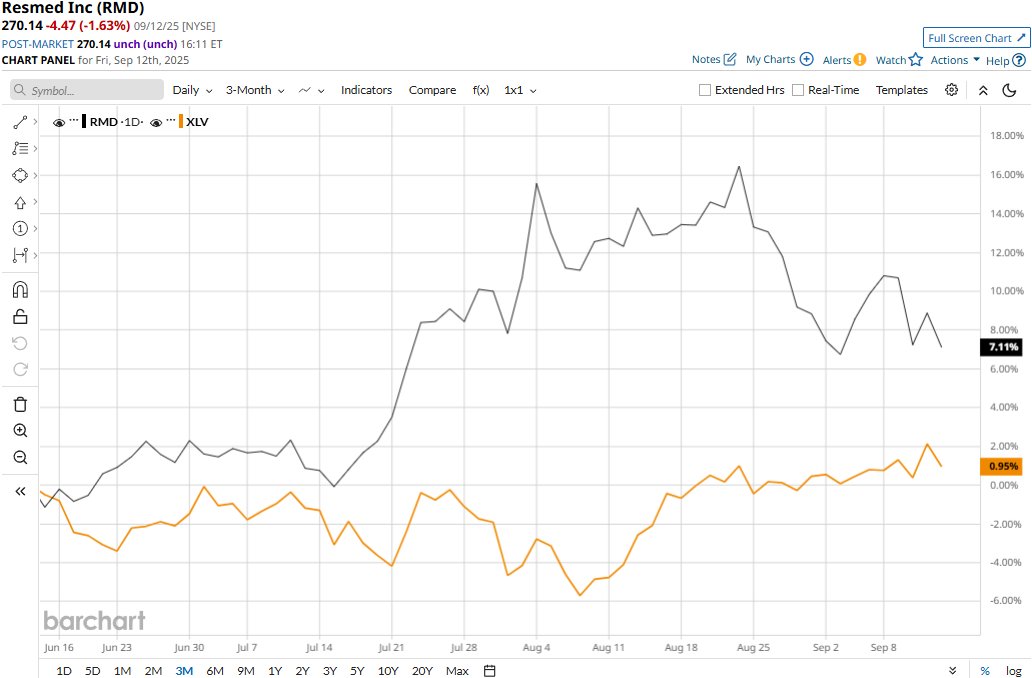

ResMed touched its three-year high of $293.81 on Aug. 22 and is currently trading 8.1% below that peak. Meanwhile, RMD has gained 7.1% over the past three months, notably outperforming the Health Care Select Sector SPDR Fund’s (XLV) marginal 95 bps uptick during the same time frame.

RMD’s performance has remained impressive over the longer term as well. RMD stock prices have surged 18.1% in 2025 and 7.8% over the past 52 weeks, outpacing XLV’s marginal 39 bps uptick on a YTD basis and 11.4% decline over the past year.

The stock has traded mostly above its 200-day and 50-day moving averages since late April with some fluctuations, underscoring its bullish trend.

ResMed’s stock prices gained 2.7% in the trading session following the release of its impressive Q4 results on Jul. 31. The company ended the fiscal 2025 on a strong note, observing a solid momentum across its business. It has continued to experience robust demand for its sleep and breathing health devices, along with expansion in its digital health services. ResMed’s overall net revenues for the quarter grew 10.2% year-over-year to $1.35 billion, surpassing the Street expectations by 1.9%. Further, its non-GAAP EPS soared 22.6% year-over-year to $2.55, exceeding the consensus estimates by 3.7%.

Moreover, ResMed has also significantly outperformed its peer, Becton, Dickinson and Company’s (BDX) 17.6% decline in 2025 and 20.7% plunge over the past 52 weeks.

The stock has a consensus “Moderate Buy” rating among the 18 analysts covering it. RMD’s mean price target of $289.25 suggests a 7.1% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.